Interviews

Telluride’s insurance play is a big bet on transparency and consumer trends.

BLANCHARD

When the idea of skiing / accident insurance first became a thing, I have to admit that I was skeptical. Skeptical and worried.

But as time went on I’ve realized a few things. First, that skiing really is risky. It’s just the way it is. Second, that risk may be what draws many people to skiing in the first place. And, third, resort transparency has increased significantly in recent years and, more than like, will only continue to rise.

As you may have heard, Telluride went all-in on accident insurance by including it with every lift ticket. Their provider of choice was Spot. We’d heard the news, but I wanted to learn more about why this moment happened. What is it about markets and consumers and resort marketing that got us to this point.

So I sat down with their Marketing Director, Greg Rossi, for a quick Q&A about them and the project.

—

Gregg: Greg, start by giving us a little bit of background on you and how you ended up at Spot.

Greg Rossi: I’ve spent my entire career in startup marketing, from video games and sports to insurance. I love the challenge of growing small companies and scaling marketing to take companies to the next level in the market and grow consumer awareness.

I ended up at Spot due to a previous founder I worked with at a past company, he is an early investor in Spot and introduced me to co-founders Matt and Maria last year and after meeting them I was really sold on the company and its mission.

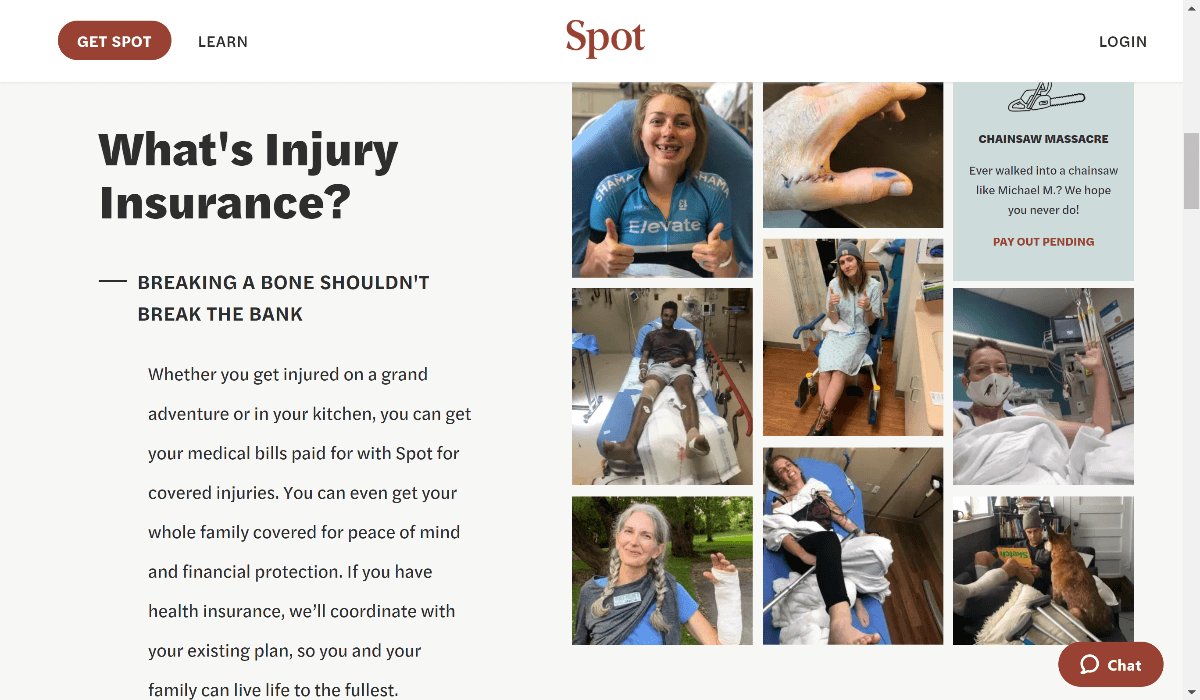

Gregg: What’s a high level view of the value proposition behind Spot?

Greg Rossi: We provide injury insurance to customers in case they get hurt doing just about any activity. Spot covers your medical bills, including your deductible if you have one, and allows you to seek treatment by any licensed physician so you can get healthy and back doing what you love. Any time you get injured, just go to the doctor and we’ll reimburse your bills for whatever they recommend. We have a simple, fully online claims process where you fill out some details about your injury and upload your bills.

Gregg: What’s the quick origin story behind the founders?

Greg Rossi: Our co-founders, Matt and Maria, came up with the idea together. Maria is an insurance industry veteran and was tired of the lack of innovation and slow pace to release new products and Matt is a serial entrepreneur. They teamed up to create this new product so that the millions of Americans with no health insurance or high deductibles don’t feel like they’re one accident away from a huge financial burden.

Gregg: What is it about investors that is driving all the activity around insurance products lately?

Greg Rossi: Insuretech in general is definitely growing like crazy at the moment. I think investors are seeing an opportunity to come in and provide valuable services that larger insurers are ignoring, and these new companies are doing a much better job of connecting with customers and demonstrating that they understand your lifestyle and your frustrations with the way insurance is done in this country.

Gregg: How about the markets? What’s happening with consumers?

Greg Rossi: Consumers now have a lot more power and choice, and they’re choosing options that align more with their values and offer them the freedom to customize products or plans to fit their needs. Any companies that come in and solve these problems are going to be very successful in the coming years.

Gregg: Talk a little bit about how this partnership with Telluride. Did they come to you? Or did you see the opportunity and approach them?

Greg Rossi: Spot actually approached Telluride and let them know about what we offer and how it can improve their overall guest experience and to their credit they were very receptive. Telluride has a history of being innovators in the industry and this is another example of them being ahead of the pack. We’ve worked with a number of other mountains on upsell opportunities so that their customers can add injury insurance to their lift tickets or season passes, but Telluride is the first to include it on all tickets that guests purchase through them.

Gregg: What was the strategy for the marketing? How did you and Telluride manage the message around this question or possibility?

Greg Rossi: While there’s always a concern around injury, we believe that it’s better to acknowledge it and be honest that injuries happen. Surveys show that a majority of would-be skiers aren’t participating due to a fear of getting hurt, so sweeping this under the rug isn’t going to solve the problem.

Gregg: So this is also Telluride trying to sending a specific message to their guests?

Greg Rossi: Exactly. By offering Spot coverage, Telluride is proving to their guests that their health and safety are a top priority – this is the message that we’ve focused on, and we feel it’s much more powerful than pretending that injuries don’t happen.

—

For further reading, here is Telluride’s insurance details page:

https://tellurideskiresort.com/ski/#Pass%20Insurance

Here is Jason Blevin’s Colorado Sun article about the partnership:

https://coloradosun.com/2021/08/20/telluride-spot-insurance-accidental-medical-coverage/

And here is a co-branded info page about the partnership:

https://www.partnerships.getspot.com/telluride

About Gregg & SlopeFillers

I've had more first-time visitors lately, so adding a quick "about" section. I started SlopeFillers in 2010

with the simple goal of sharing great resort marketing strategies. Today I run marketing for resort ecommerce and CRM provider

Inntopia,

my home mountain is the lovely Nordic Valley,

and my favorite marketing campaign remains the Ski Utah TV show that sold me on skiing as a kid in the 90s.

Get the weekly digest.

New stories, ideas, and jobs delivered to your inbox every Friday morning.