Branding

Ikon Pass: marketing, branding, pricing, and timeline.

BLANCHARD

I’ve followed the stories of various passes in various ways. With the Ikon Pass, I’m gonna try something different. Instead of writing a handful of different posts as details come available, I’ll put it all here in one timeline of collateral, details, and reactions.

Tuesday, March 6, 2018

That Tuesday in March has finally arrived and both passes are now on sale. But before we dig into that, let’s do a quick refresher because it was only 5 weeks ago that I tweeted this:

If you're a business that's built an empire on a single pass and you've known for 7+ months that a competitor was coming and you've got boatloads of cash and savvy leadership, what response do you concoct while your new competitor is busy working on names and logos and paperwork?

— Gregg Blanchard (@slopefillers) January 25, 2018

Did Vail respond? What kind of a question is that? ;)

Aside from the Telluride news I mentioned in an earlier update, they’ve also come out with three other headline-worthy moves:

Kicking Horse, Fernie & Resorts of the Canadian Rockies join the Epic Pass! The Epic Pass, Epic 7-Day and Epic 4-Day passes will have direct-to-lift access to the Resorts of the Canadian Rockies in the 2018/19 season. Passes on sale March 6. https://t.co/PgEv3NCBzT #10YearsOfEpic pic.twitter.com/lHBow5mfv0

— VailResorts (@VailResorts) March 5, 2018

Hakuba Valley, Japan joins the Epic Pass! Epic Pass and Epic Local Pass will include 5 consecutive days access to Hakuba Valley, Japan, in the 2018-19 winter season w/ no black out dates! Epic Pass and Epic Local passes will go on sale March 6 https://t.co/PgEv3NCBzT. pic.twitter.com/3338NtGlNO

— VailResorts (@VailResorts) March 2, 2018

We honor the service of our 10th Mountain Division founders, U.S. Armed Forces members, and Canadian and Australian military service members with a $99 Military Epic Pass. For every 2018-19 season pass sold, $1 will be donated to @WWP #10YearsOfEpic. https://t.co/YP7SQBGiii pic.twitter.com/2esX9T7CCO

— VailResorts (@VailResorts) March 1, 2018

Perks in Japan, perks at a half-dozen resorts in the Canadian Rockies, and a $99 pass for members of the military. According to multiple sources (I haven’t tried to count myself) that brings the total number of mountains with perks on the Epic Pass to 61.

Price

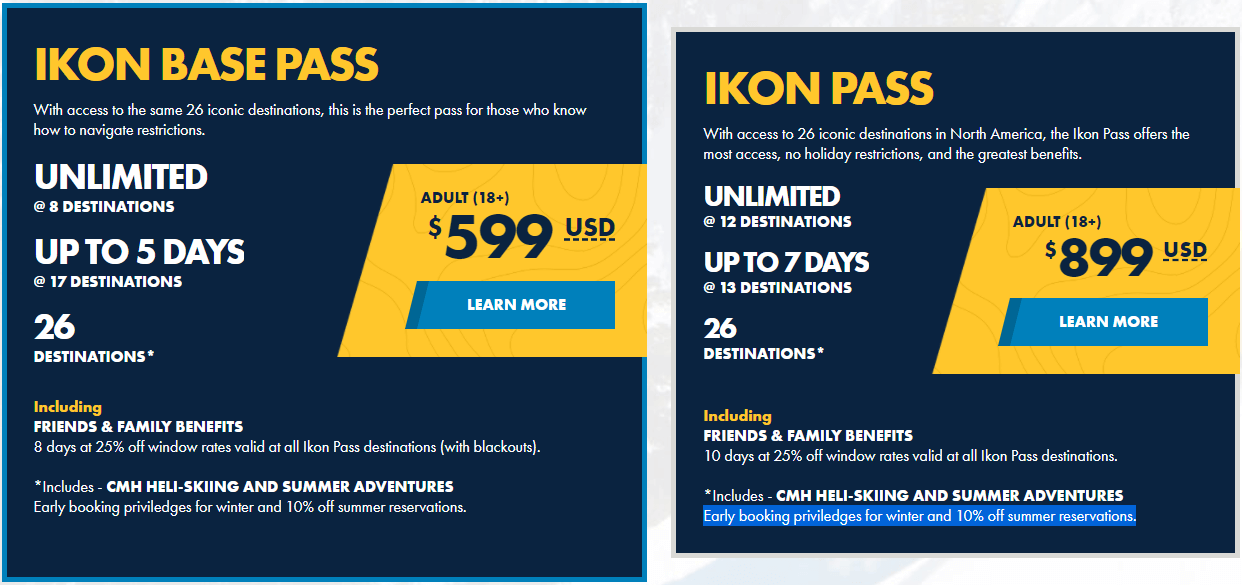

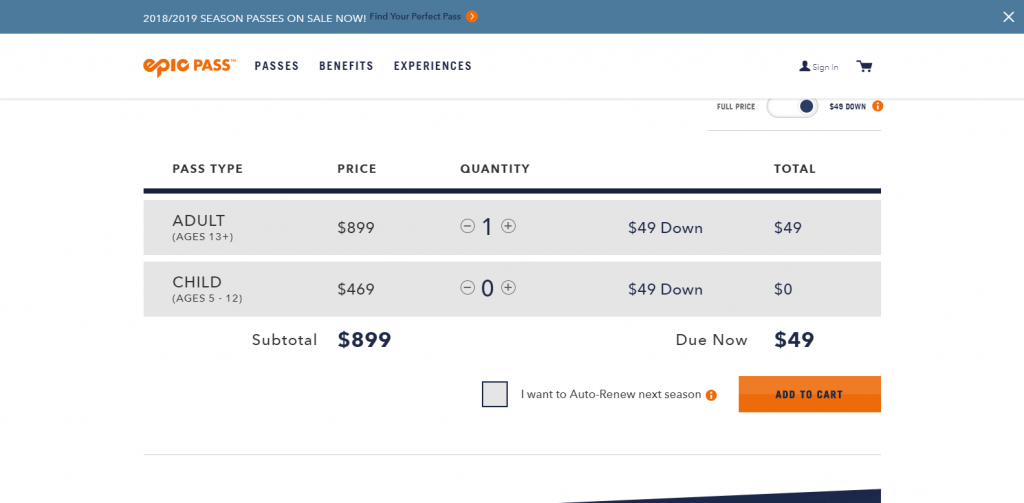

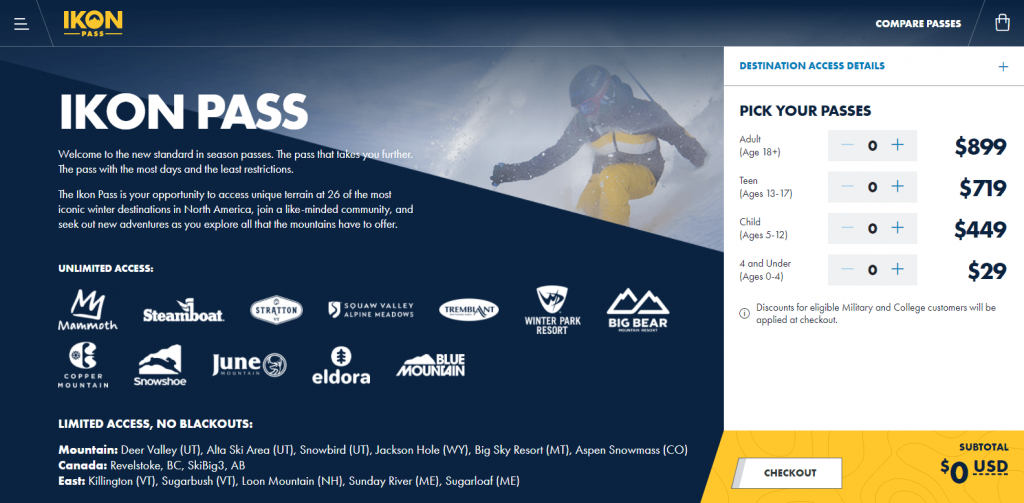

Which brings us to the final question we needed an answer to today: price. We knew the Ikon pass would come in at $899 for their top-tier option, but what would Epic Pass do? Well, take a look at the screenshots of both checkouts today:

Yep, identical.

Higher tiers will surely come later in the fall, but right now both are selling for $899 with small variances between types below that.

This is a really, really good thing to see. Parity on price tells me that Ikon and Epic are going to compete on value. No race to the bottom, no forcing smaller mountains to drop pass prices even further. In terms of the overall health of the industry, it’s the healthiest approach we could have hoped for.

We are absolutely going to see a battle for passholders and loyalty the likes of which skiing has never seen, but I’m glad to see early signs that this won’t include the deep discounting of decades gone by. Now let’s just hope we see the same next year and beyond.

Thursday, Feb 22, 2018

Welp, we didn’t have to wait long and we didn’t even have to wait for the pass to go on sale, according to the Ikon Pass site and and article by Jason Blevins of Denver Post fame:

“Alterra Mountain Co. has thrown down an $899 season pass that offers unlimited skiing at 12 resorts and…the $599 Ikon Base Pass provides unlimited access to eight ski areas.”

So which resorts are unlimited and which resorts are not? It gets a little confusing, but here’s Jason’s Colorado-focused rundown:

“…unlimited access to Winter Park, Copper Mountain, Steamboat and Eldora and eight ski areas in California, Vermont, West Virginia and Canada, plus seven days of skiing each at six destination resorts: Utah’s Deer Valley, Wyoming’s Jackson Hole, Montana’s Big Sky, Canada’s Revelstoke, and Vermont’s Killington and Sugarbush. It also comes with a total of seven days at the four Aspen Snowmass resorts, AltaSnowbird in Utah, SkiBig3 in Canada (Banff Sunshine, Lake Louise and Mt. Norquay), and the trio of Sunday River, Sugarloaf and Loon Mountain in New England.”

So confusing that my initial version of this was actually incorrect. It’s not 1 group of resorts you share 7 days across, it’s actually 3-4 (depending on you count Aspen Snowmass as 1 or 4). So some are unlimited, some get 7 days EACH, and some are in a group that give 7 days COMBINED. As best as I can tell, here’s that breakdown in table form.

| Resort | Unlimited Some restrictions on “Base” Pass |

7 Days Each 5 on “Base” Pass |

| Alta | *7 total between Alta & Snowbird |

|

| Aspen/Snowmass | ||

| Big Bear | ||

| Big Sky | ||

| Blue Mountain (CA) | ||

| CMH | ||

| Copper | ||

| Deer Valley | ||

| Eldora | ||

| Jackson Hole | ||

| June Mountain | ||

| Killington | ||

| Loon | *7 total between Loon, Sugarloaf, Sunday River |

|

| Mammoth | ||

| Revelstoke | ||

| SkiBig3 | *7 total between Banff, Sunshine, Lake Louise |

|

| Snowbird | *7 total between Alta & Snowbird |

|

| Snowshoe | ||

| Squaw Alpine | ||

| Steamboat | ||

| Stratton | ||

| Sugarbush | ||

| Sugarloaf | *7 total between Loon, SL, SR |

|

| Sunday River | *7 total between Loon, Sugarloaf, Sunday River |

|

| Tremblant (CA) | ||

| Winter Park |

NOTE: CMH only includes discounts to passholders, not free skiing.

We’ve been told many times that the Mountain Collective isn’t going away, but notice the new names on that list? Yep, Revelstoke, Sugarbush, and SkiBig3. What pass are they currently part of? The Mountain Collective. The only domestic, Mountain Collective resorts not on the pass are Snowbasin, Sun Valley, and Taos (and Telluride, technically, but that ship has sailed).

Initial reaction is three-fold.

First, the price is a touch higher than I expected but give the size of this group it’s certainly justified. The Epic Pass has proven that an $800-$900 pass can sell, so I don’t see any cause for concern there. Considering the chain reaction they could cause by trying to undercut Epic, I’m glad they’re slightly above.

Second, it is a confusing pass. Epic has a simple “unlimited everywhere” concept that’s easy to grasp and see value in. The complexity of three different use types that differ across the two pricing tiers across the resorts (sprinkled with some blackout days at Squaw) and you’ve got something that will certainly be a messaging challenge.

Third, I’m a bit surprised they let the cat out of the bag early. Perhaps it’s to avoid pricing wars and let Vail know in advance they aren’t going to play that game, but I think this slow trickle of information is an interesting approach that I hope won’t lead to a sad trombone kinda roll out on March 6.

Early thoughts, but will report back once they simmer a bit.

Tuesday, Feb 13, 2018

Whenver stuff like the a new pass drops, I have to give myself a couple weeks to process it. That time has passed, so here’s an update.

First, I’ve mostly forgotten about the “K” which I figured I would. That’s good news.

Second, their Instagram account gives us a few more tidbits into their brand and position than we get on the website thanks to the classic three-picture spans toward the bottom of their feed.

We’ve all seen the “iconic” angle of the Ikon pass’s name and position…

…but two more show up as well:

I’ve been getting hints that the brand’s position will be built around the unique character of each resort in contrast to Vail’s perception of one-size-fits-all / cookie-cutter and the “community” angle hints that vibe may be correct.

Third, my only concern with that is how widespread the perception actually is. For example, take an industry insider or deeply passionate skier and you’ll find someone who has followed skiing business, has perhaps read Downhill Slide, and sees Vail Resorts’ mountains as the epitome of soulless. You’ll also likely hear some reference to “faux alpine villages”, etc.

But I’ve actually never heard these sentiments outside of a very tight group of ski industry voices. Instead, the destination skiers I’ve talked to love those resorts and villages and vibes.

I like the position and I’m guessing on a few layers here given how much info is public, but I’m just not sure how strong this direction could be in the market.

Fourth, the three-picture spans on Instagram are a reminder that once you go down that path, it’s tough to stop. If you look at the timestamps on their last 9 posts you’ll see why:

- Wed, Feb 7, 2018

- Wed, Feb 7, 2018

- Wed, Feb 7, 2018

- Mon, Feb 5, 2018

- Mon, Feb 5, 2018

- Mon, Feb 5, 2018

- Wed, Jan 31, 2018

- Wed, Jan 31, 2018

- Wed, Jan 31, 2018

Posting in threes works pretty well for Ikon given how many mountains they have to talk about, but it can be tricky road to go down for those without the volume of content or time/people to manage.

Overall, though, I’m liking what I’m seeing and I’m excited for the first couple weeks of March when the real hammers drop (like price and, I’m guessing, yet another move from Vail besides the Telluride news).

Get ready to check another mountain resort off your bucket list: @Telluride is officially joining the #EpicPass. Press Release | https://t.co/6DPJSNl5sB pic.twitter.com/2vHwJDnfUf

— VailResorts (@VailResorts) January 29, 2018

Friday, Jan 26, 2018

Vail has Vonn and Ikon has Shiffrin. I’ve always liked that Mikaela has managed to keep her personality during her rise and, while her dominance is more “iconic” in this context, that probably plays into Ikon’s messaging as they position themselves against Vail’s more systematic approach to resorts and marketing.

Welcome to the #IkonPass family, @MikaelaShiffrin. Good luck in #PyeongChang2018. #WeAreTheMTNs pic.twitter.com/rSfBpeV2U0

— Ikon Pass (@IkonPass) January 26, 2018

With the FAQ section of the Ikon Pass website stating that “the M.A.X. Pass will not be available for winter 2018/2019” I figured it’d be a good time to get things straight given 64 different resorts have been involved in one of the three.

| Resort | M.A.X. | Mountain Collective | Ikon Pass |

| Alta | |||

| Alyeska | |||

|

Aspen Snowmass

|

|||

|

Banff Sunshine (CA)

|

|||

| Belleayre | |||

| Big Bear | |||

| Big Sky | |||

| Blue Mountain (CA) | |||

| Boreal | |||

| Boyne Highlands | |||

| Boyne Mountain | |||

| Brighton | |||

| Buck Hill | |||

| CMH | |||

| Copper | |||

|

Coronet Peak (NZ)

|

|||

| Crested Butte | |||

| Crystal | |||

| Cypress (CA) | |||

| Deer Valley | |||

| Eldora | |||

| Fernie (CA) | |||

| Gore | |||

| Granite Peak | |||

| Jackson Hole | |||

| June Mountain | |||

| Kicking Horse (CA) | |||

| Killington | |||

| Kimberly (CA) | |||

|

Lake Louise (CA)

|

|||

| Lee Canyon | |||

| Loon | |||

| Lutsen | |||

| Mammoth | |||

| Mont Sainte-Anne (CA) | |||

| Mount Sunapee | |||

| Mountain Creek | |||

| Mountain High | |||

| Mt Bachelor | |||

| Nakiska (CA) | |||

| Okemo | |||

| Pico | |||

| Revelstoke (CA) | |||

|

Snowbasin Resort

|

|||

| Snowbird | |||

| Snowshoe | |||

| Solitude | |||

|

Squaw Valley Alpine Meadows

|

|||

| Steamboat | |||

| Stoneham (CA) | |||

| Stratton | |||

| Sugarbush | |||

| Sugarloaf | |||

| Summit at Snoqualmie | |||

| Sun Valley | |||

| Sunday River | |||

| Taos | |||

| Telluride | |||

| Thredbo (AUS) | |||

| Tremblant (CA) | |||

| Wachusett | |||

| Whiteface | |||

| Windham | |||

| Winter Park |

Also, love this analysis from Peter at LiftBlog regarding lifts. On which Ikon clearly has an advantage.

Number of lifts in North America: 3,062

Number of lifts on the #IkonPass: 363

Number of lifts on the #EpicPass: 234

Number of lifts not on the Ikon or Epic: 2,465

*excludes carpets, rope tows and lifts outside North America— Lift Blog (@liftblog) January 25, 2018

Thursday, Jan 25, 2018

The Twitter account is no longer private and is now sharing content making me think that today was supposed to be the official launch and that video board ad may in fact have been an error. Either way, a video kicks it off:

1 pass. Iconic destinations. Infinite adventure. We’re the #IkonPass. It’s nice to meet you. #WeAreTheMTNs https://t.co/fSnU1qnt9A pic.twitter.com/elepMqV4FB

— Ikon Pass (@IkonPass) January 25, 2018

Followed by a map of all the resorts:

Listed out, here’s what we’ve got:

- Steamboat

- Winter Park

- Aspen Snowmass

- Copper

- Eldora

- Squaw Valley Alpine Meadows

- Mammoth

- Big Bear

- June Mountain

- Jackson Hole

- Big Sky

- Stratton

- Killington

- Snowshoe

- Tremblant

- Blue Mountain

- Sugarloaf

- Sunday River

- Loon

- Deer Valley

- Alta

- Snowbird

- CMH

Some of those names came as a bit of a surprise, but in the FAQ’s they state that:

QUESTION: DOES ALTERRA MOUNTAIN COMPANY NOW OWN THE PARTNER DESTINATIONS?

Answer: No, all destination partners remain independent. POWDR operates Killington Resort, Copper Mountain Resort, and Eldora Mountain Resort; Aspen Skiing Company operates Aspen Snowmass; Boyne Resorts operates Big Sky Resort, Loon, Sunday River, and Sugarloaf; Alta Ski Area, Jackson Hole Mountain Resort and Snowbird are independent entities.

Looks like we’ll be taking at least a short break from acquisitions. In the meantime we can follow the pass’s new social accounts:

And enjoy looking through Ikon Pass’ new website:

I like the branding, the colors are good but surprisingly close to the EpicPass (yellow + blue vs orange + blue). Lots still to learn and the price will be a bit part of that.

Still hung up on the K but not as much as yesterday. Progress. :)

Also starting to see resorts reach out with Ikon-created content on their own channels.

We're proud to be part of the @IkonPass for the 18/19 season, the new standard in season passes. #WeAreTheMTNs pic.twitter.com/WwwE1UVVQG

— Big Bear Mountain Resort (@BigBearMtResort) January 25, 2018

Wednesday, Jan 24, 2018

A bit of an odd way to hear about the pass, but The Denver Post’s Jason Blevins tweeted about it first by sharing this video board from SIA/OR in Denver.

As @VailResorts boss Rob Katz kicks off #ORShow, #Alterra drops name of new pass to rival #EpicPass: #IkonPass pic.twitter.com/DoT0tyCwuN

— Jason Blevins (@jasonblevins) January 24, 2018

Soon after, Ski Big 3’s Chris Lamothe shared a picture along with the twitter handle (@ikonpass) he had tracked down.

Looky looky, @IkonPass is a thing. #ikonpass pic.twitter.com/LDYnMI59yw

— Chris Lamothe (@banffchris) January 24, 2018

At the time, the Twitter handle was still private (which made me think that, perhaps, the video board was not supposed to show what it did when it did) but we did get a first glimpse of the logo.

At the time, the Twitter handle was still private (which made me think that, perhaps, the video board was not supposed to show what it did when it did) but we did get a first glimpse of the logo.

With the Twitter handle, we got a first look at the tagline which helped clarify the use of “Ikon” in the name as “iconic” seems to be setup as the key, central word in the brand and messaging.

The most iconic mountains in North America. A new standard in season passes.

Not sure how I feel about the K in Ikon (kinda reminds me of the apartment complex my friends lived in during college named Kampus Korner) but like all things, will probably get over it.

About Gregg & SlopeFillers

I've had more first-time visitors lately, so adding a quick "about" section. I started SlopeFillers in 2010

with the simple goal of sharing great resort marketing strategies. Today I run marketing for resort ecommerce and CRM provider

Inntopia,

my home mountain is the lovely Nordic Valley,

and my favorite marketing campaign remains the Ski Utah TV show that sold me on skiing as a kid in the 90s.

Get the weekly digest.

New stories, ideas, and jobs delivered to your inbox every Friday morning.